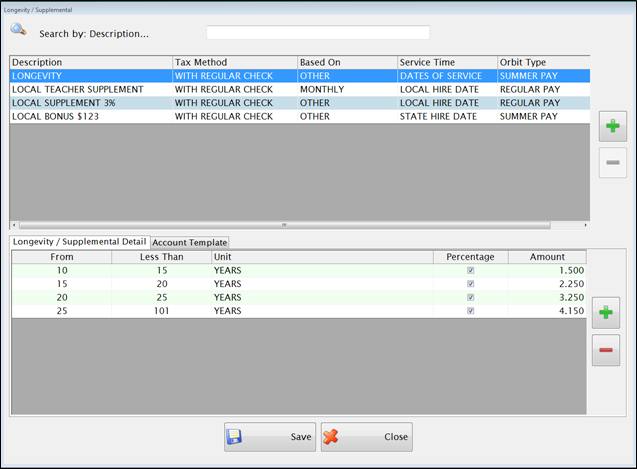

The Longevity/Supplemental Setup sets up Longevity pay rates, as well as any other extra pay (i.e. local supplements).

Complete the following form to add Longevity or Supplemental pay:

Supplemental calculates using supplemental rates from tax tables.

Without Regular Check calculates taxes as if this is the only check this year.

None indicates no Federal or State taxes are withheld. (Social Security and Medicare still apply unless the Employee Job is exempt from them.)

Based On determines how the supplemental pay amount is calculated if it is a percentage of the employee’s pay.

Other calculates based on the employee’s annual pay for the associated job.

Service Time is based on the Employee’s State Hire Date or the Employee’s Local Hire Date on the Dates of Service tab from Manage Employee.

ORBiT Type determines how this supplement record will be reported in the ORBiT file. If this field is left blank, the record will be reported as Regular pay.

To add a new pay type, click the green plus button for the upper grid.

A new row appears in the upper grid.

Enter a description for this supplemental pay item in the Description field.

Select Other, Monthly, Weekly, Every Two Weeks or Twice a Month from the Based On dropdown list.

Select Dates of Service, State Hire Date, or Local Hire Date from the Service Time dropdown list.

Select Regular Pay or Summer Pay from the ORBiT Type dropdown list.

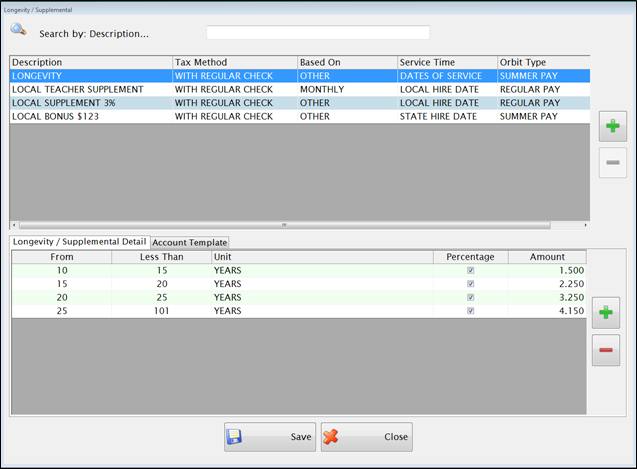

LONGEVITY/SUPPLEMENTAL DETAIL TAB

The Longevity/Supplemental Detail tab displays the details for the selected pay type.

Set up the Percentages or Amounts for the selected supplementary pay item.

Select the values that apply for From, Less Than and Unit for this supplemental pay. If the same amount applies to all employees who qualify, you only need one row. If the amount or percentage varies based on length of service, set up multiple rows, one for each service range.

Check Percentage if applicable. Leave unchecked if the pay is a flat amount.

Enter the Amount or Percentage in the last column.

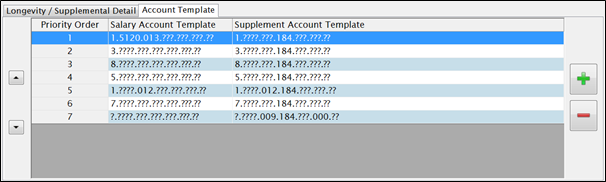

ACOUNT TEMPLATE TAB

The Account Template determines the default Account Code for the supplemental pay item. At least one is required, but you may have many as needed.

NOTE: The account number can be modified in Employee Job setup if a different account should be used for Longevity Pay for a specific employee.

or

or  arrows on the left of the grid to move the selected template up or down in priority.

arrows on the left of the grid to move the selected template up or down in priority.

©2019 EMS LINQ, Inc.

Payroll, revised 04/2019