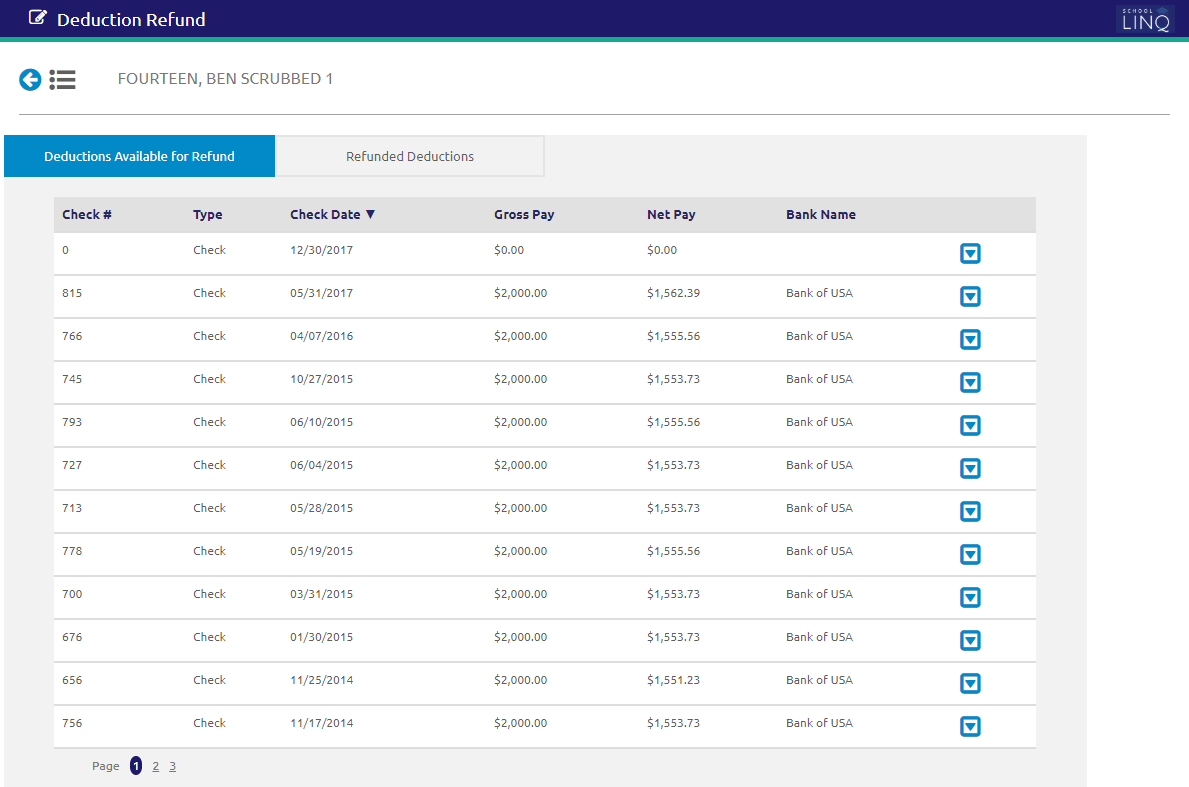

Deduction Refund - Deductions Available for Refund Tab

This tab lists all available absences that can be refunded.

Process Refunds

- Click the

icon to view more information about the Deduction.

icon to view more information about the Deduction. - Check the

boxes next to the Deductions to be refunded.

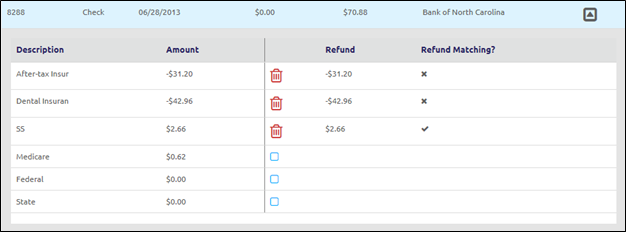

boxes next to the Deductions to be refunded.

- Enter the amount to be refunded in the Refund field.

-

The Refund Matching? column will automatically display a

or

or  if the employer matching on this deduction should also be reversed. NOTE: If a partial refund is required, you may modify the hours here. Only one partial refund may be in process for an deduction at a time.

if the employer matching on this deduction should also be reversed. NOTE: If a partial refund is required, you may modify the hours here. Only one partial refund may be in process for an deduction at a time.

- Click the

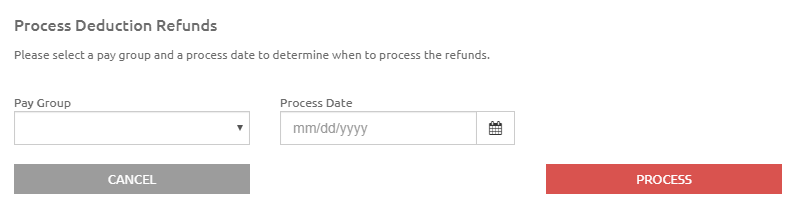

button to process the deduction refunds.

button to process the deduction refunds.

-

Select a pay group from the Pay Group drop-down list.

- Enter or select a Process Date using the Calendar feature to determine when the refund check will be issued. The refund does not have to be in a special group or period. It can be combined with their regular check if desired.

- Click the

.png) button.

button.- Once a deduction refund is processed, it will be listed with the Input: Other Pay items for the selected pay group.

- If corrections are required after processing, delete it from Other Pay and reprocess it under Deduction Refund with the corrections.

NOTE: When a deduction that was tax-exempt is refunded, taxes will be deducted if they normally apply to this Employee Job.

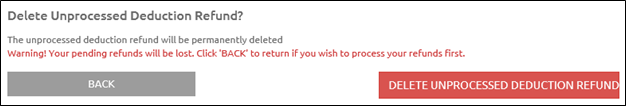

Delete Unprocessed Deductions

Deduction Refunds that have been processed but not fully refunded to the employee can be reversed.

- Click the

icon to reverse the Deduction Refund.

icon to reverse the Deduction Refund.

- Click the Back button to return to the previous page without reversing the refund, or the Delete Unprocessed Deduction Refund button to permanently delete the refund.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021