Federal 941 Report

The Federal 941 Report is a federal report due quarterly. It is used to report an employer’s payroll tax liability.

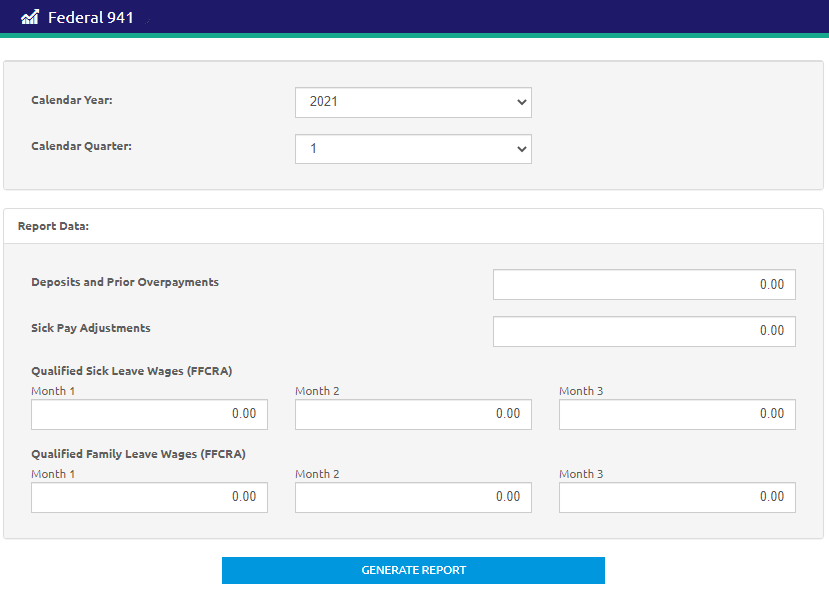

- Select the year you are reporting from the Calendar Year drop-down list.

- Select the quarter you are reporting from the Calendar Quarter drop-down list.

- If applicable, enter the information in the following fields:

- 2020 Quarter 1 and before:

- Enter the amount in the Deposits and Prior Overpayments field.

- Enter the amount in the Sick Pay Adjustments field.

- Enter the payment assistance amount in the COBRA premium assistance payments field.

- Enter the amount in the Number receiving COBRA assistance field.

2020 Quarter 2 and after:

- Enter the amount in the Deposits and Prior Overpayments field.

- Enter the amount in the Sick Pay Adjustments field.

- If you had Federal leave related to the FFCRA, enter the related earnings amounts for each month in the Qualified Sick Leave Wages (FFCRA) field.

- If you had Federal leave related to the FFCRA, enter the related earnings amounts for each month in the Qualified Family Leave Wages (FFCRA) field.

- 2020 Quarter 1 and before:

- Click the

button to create the report.

button to create the report.

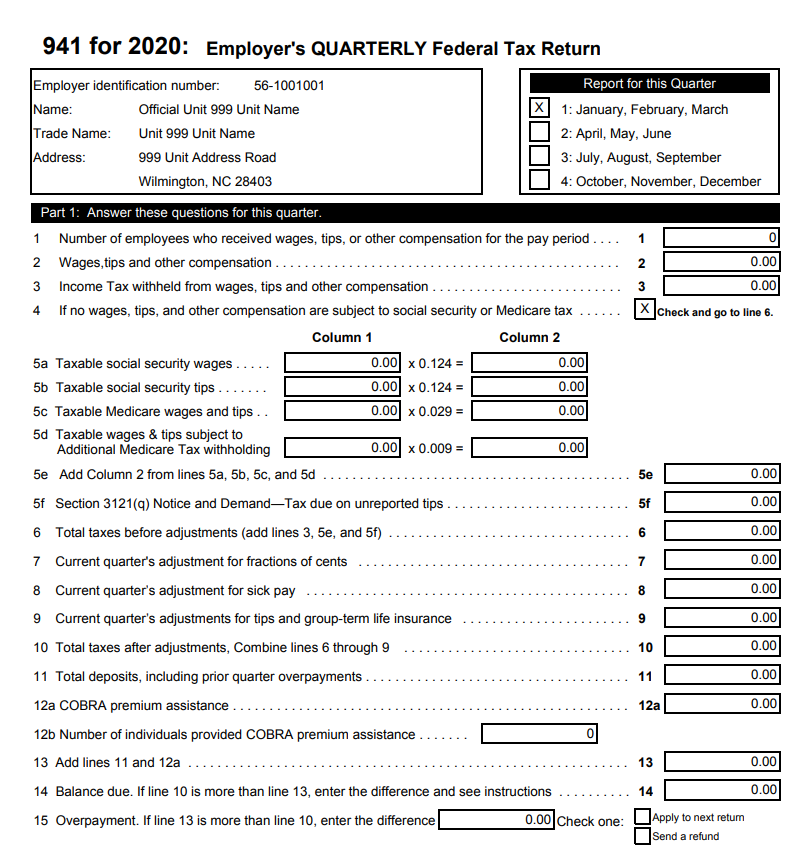

Sample 941 Report

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021