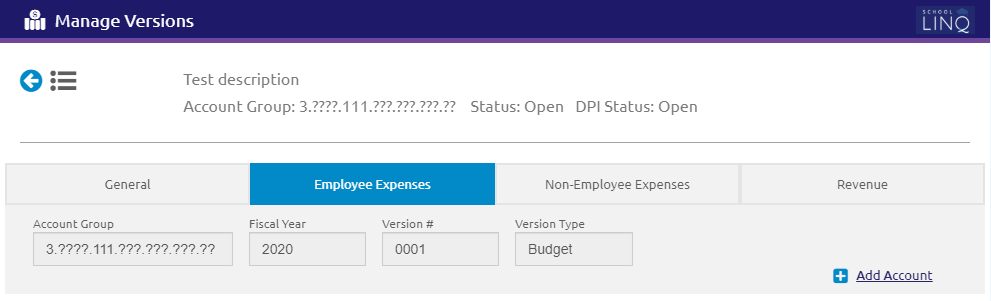

Manage Versions - Employee Expenses Tab

This tab is used to create, manage, and display all employee expenses.

Add Account

- Click the

link to add an expense account.

link to add an expense account.

- Enter the account number in the Account Number field. Account numbers MUST be unique within the version.

- For Fund 3, the account number must be an active, valid account according to DPI standards.

- Enter a description in the Account Description field.

- Select a classification from the Employee Class drop-down list.

- Indirect Cost and Admin Cost check boxes are read-only.

- For initial budgets, enter a justification for the expense in the Justification text box.

- Account Total is calculated automatically.

- Click the

button.

button.

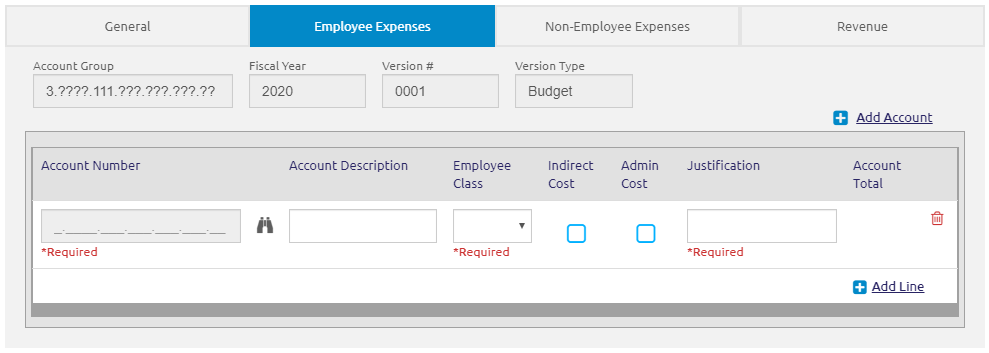

Add Line

- Click the

link to add a new line to this expense account.

link to add a new line to this expense account.

The first line is read-only, and fields will populate as they are filled in the Pay Information, Employee Information, and Justification sections.

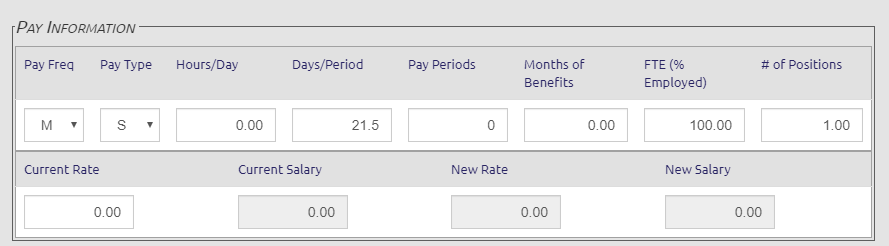

Pay Information

- Select

a frequency from the Pay

Freq drop-down list.

- B = Biweekly

- S = Semi-monthly

- M = Monthly

- A = Annually

- W = Weekly

- Select

a type from the Pay Type

drop-down list.

- S = Salary

- H = Hourly

- D = Daily

- Enter the amount in the Hours/Day field. This is only required for an hourly pay type.

- Enter the amount in the Days/Period field.

-

Enter the number of pay periods for this position in the Pay Periods field.

- Enter the number of months the benefit will be received in the Months of Benefits field. This can be different from the number of Pay Periods. Example: A teacher has 10 pay periods but receives benefits for 12 months)

- Enter the percent employed for this position in the FTE (% Employed) field.

- Enter the number of positions being budgeted in the # of Positions field.

-

Enter current pay for this position in the Current Rate field.

- Pay frequency and pay type should be considered. Example: If the frequency is Monthly and the pay type is Salary, the current rate would be the monthly salary. If pay type is Hourly, this would be the hourly rate.

- Current Rate cannot exceed $99,999.99 per DPI requirements.

- The Current Salary

field is read-only and is calculated based on Pay Type.

- For Salary: Current Salary = Current Rate x Pay Periods x FTE

- For Hourly: Current Salary = Current Rate x Hours per Day x Days per Period x Pay Periods x FTE

- For Daily: Current Salary = Current Rate x Days per Period x Pay Periods x FTE

- The New Rate field is read-only and is calculated by applying the salary increase percent/amount for this employee’s classification type to the current rate.

- The new annual salary is calculated in the New Salary field and is read-only.

- Click the

button.

button.

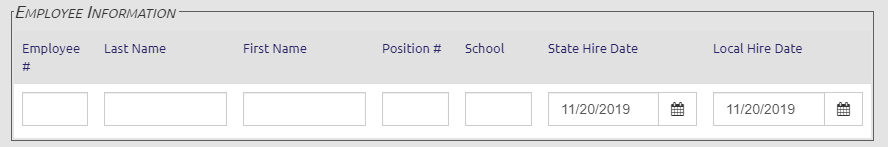

Employee Information

-

Enter the employee ID number in the Employee ID field.

-

Enter the employee’s last name in the Last Name field.

-

Enter the employee’s first name in the First Name field.

- Enter the position ID in the Position # field.

- Enter the site name in the School field.

-

Enter the employee’s hire date for the State in the State Hire Date using the calendar feature.

-

Enter the employee’s local hire date in the Local Hire Date using the calendar feature.

- Click the

button.

button.

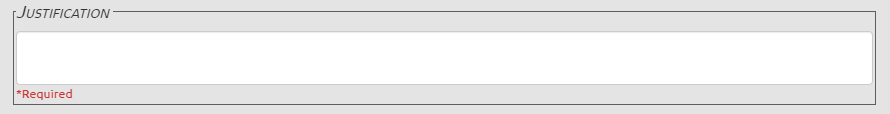

Justification

- Enter the justification for the position in the Justification text box. Required on all Fund 3 Budgets and Amendments.

- Click the

button.

button.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021