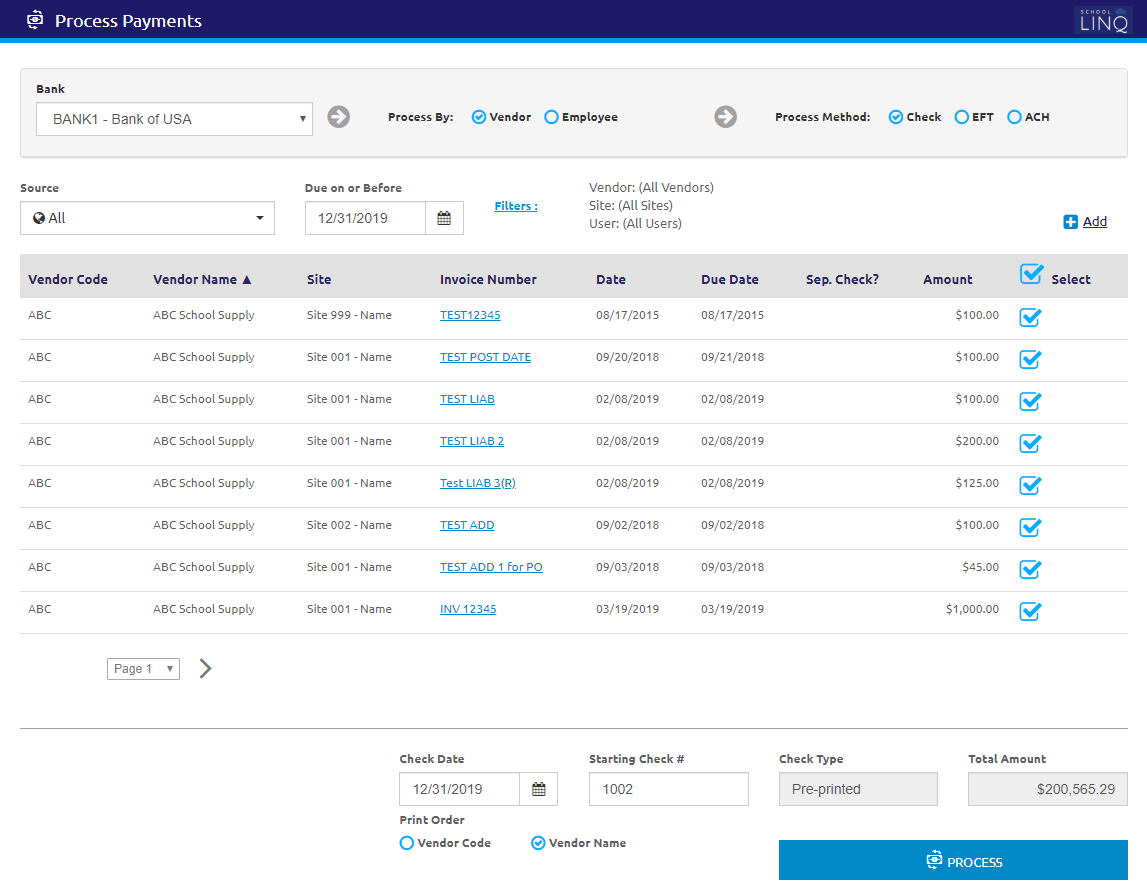

Process Payments

Process Payments allows users to print checks and process ACHs or EFTs (Electronic Fund Transfers).

Search Invoices

-

Select the bank from the Bank drop-down list to display all the outstanding invoices that have been accrued under Accounts Payable.

- Select Vendor or Employee to Process By.

- Select Check, EFT, or ACH for Process Method.

- If ACH is selected, the

button will display.

button will display. - Click the

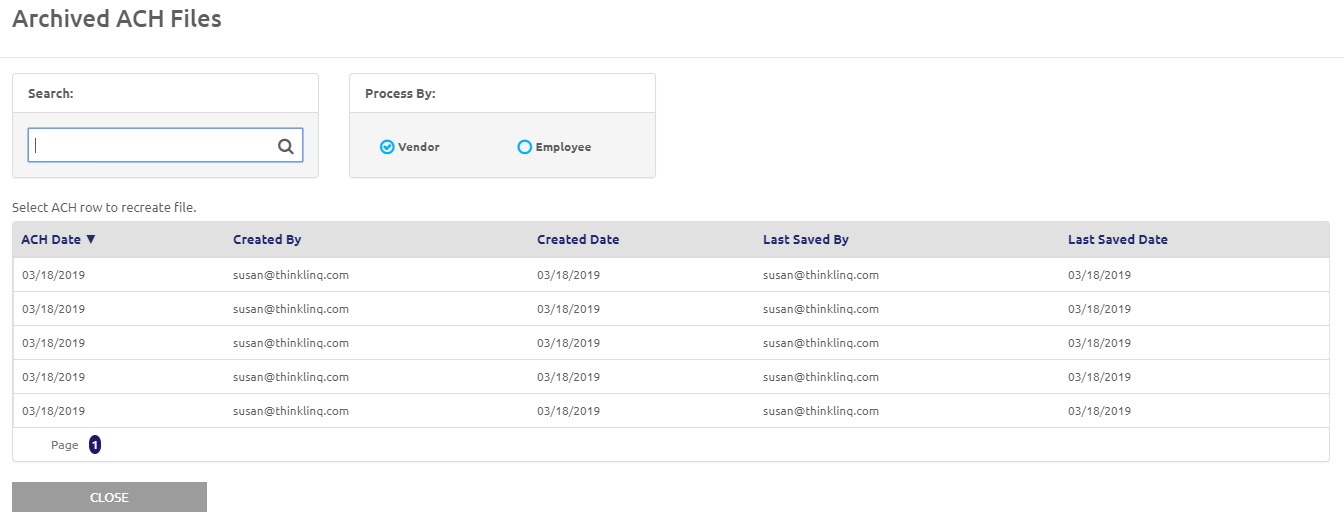

button to retrieve or recreate an ACH file that was previously created. The Archived ACH Files grid will display.

button to retrieve or recreate an ACH file that was previously created. The Archived ACH Files grid will display.

Enter a name in the

field to search for an ACH file.

field to search for an ACH file.- Select either Vendor or Employee to Process By.

- Select an ACH row from the grid to recreate the file.

- Click the

button to return to the Process Payments grid.

button to return to the Process Payments grid.

- If ACH is selected, the

- Select the source from the Source drop-down list.

- Enter or select a Due on or Before date using the Calendar feature.

IMPORTANT! ACH Processing - If the cash account associated with the invoice is attached to the bank selected in ACH Setup, then normal accounting will be used and no system-generated invoice will be created. Intra-fund accounting, including the system-generated invoice, will only be used if the cash account is not associated with the ACH bank. ACH Debit and ACH Credit account masks no longer need to be set to all '?'s to prevent a system-generated invoice to the ACH vendor. If your unit would like assistance setting up Fund Management ACH for vendors and/or employee reimbursement invoices, please contact LINQ Support at 800.541.8999.

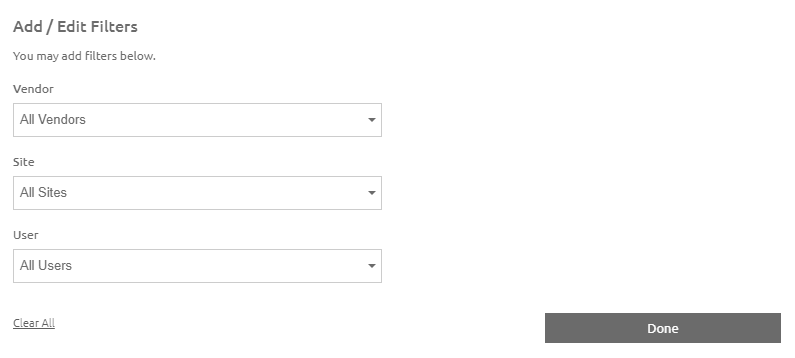

Add / Edit Filters

- Click the

link. The Add / Edit Filters form will display.

link. The Add / Edit Filters form will display.

- Select a vendor from the Vendor drop-down list.

- Select a site from the Site drop-down list.

- Select a user from the User drop-down list.

- Click the

.png) button.

button.

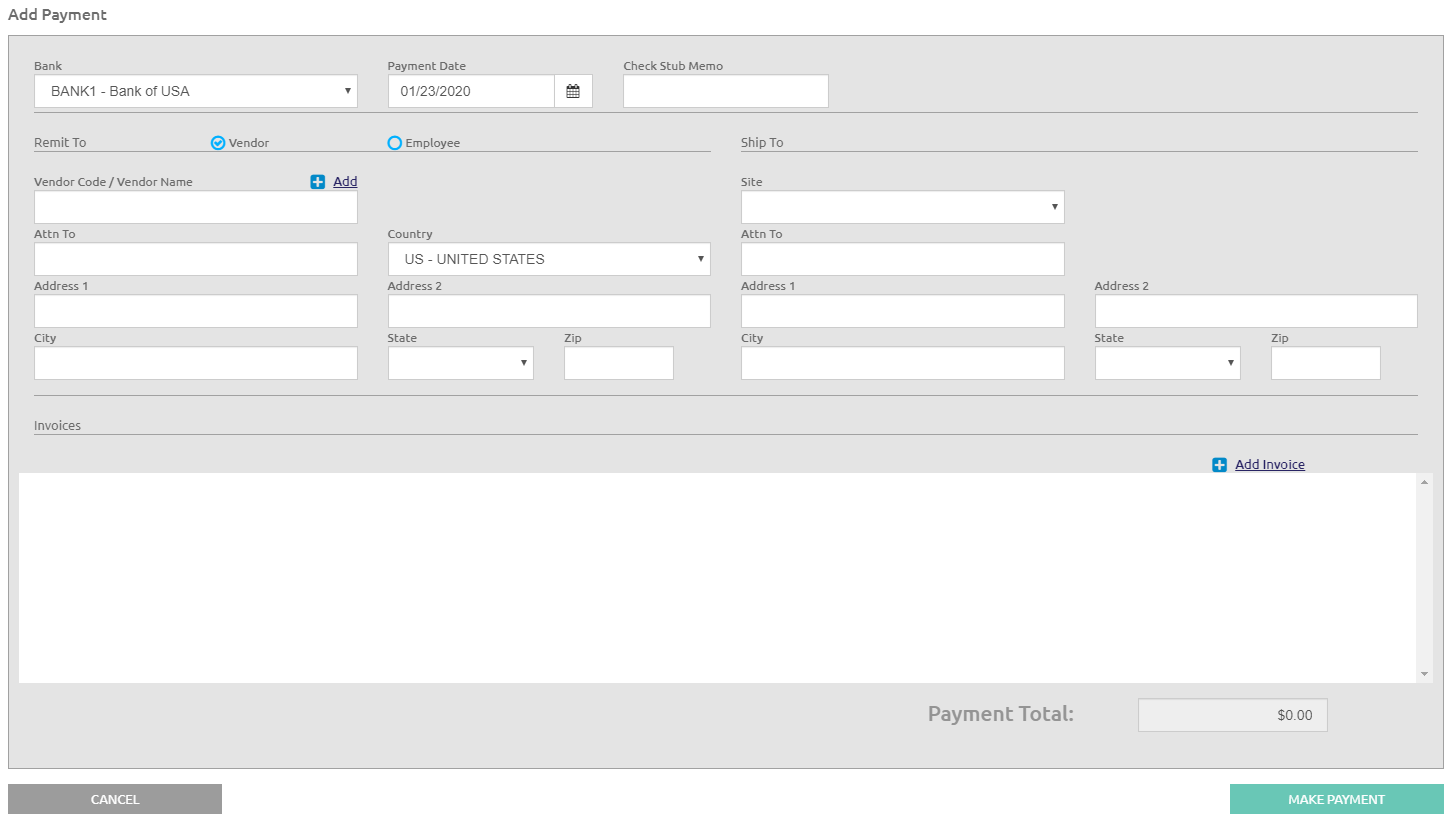

Add Payment

-

Click the

.png) link to quickly pay invoices for a vendor that has not been added through Manage Invoices. The Add Payment form will display.

link to quickly pay invoices for a vendor that has not been added through Manage Invoices. The Add Payment form will display.

- Select the bank from the Bank drop-down list.

- Enter or select the Payment Date using the Calendar feature.

- Enter a Check Stub Memo. This is optional.

Remit To

- Select Vendor or Employee to Remit To.

- Enter a Vendor Code or Vendor Name.

- The remaining Remit To fields will default from the vendor selected, but these are editable.

- Depending on the vendor entered, the Starting Check # field, Print Order selections, or Starting EFT field will display at the top of the form. If the Attn To field is populated, it will print on the check.

OR

- Click the

.png) link to add a vendor. The Add Vendor form will display.

link to add a vendor. The Add Vendor form will display. - Enter the Vendor Code, Address information, Vendor Name, and Tax ID.

- Click the

button.

button.

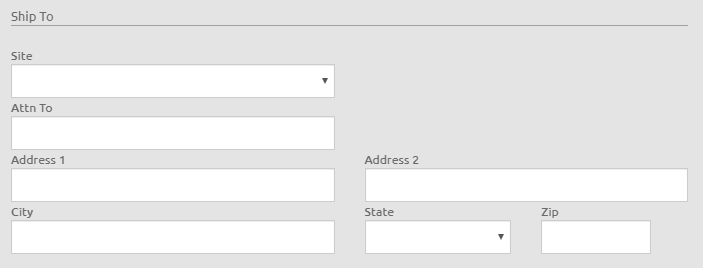

Ship To

- Select the Site from the Site drop-down list.

- The Attn To and Address fields will default from the Site selected, but these are editable.

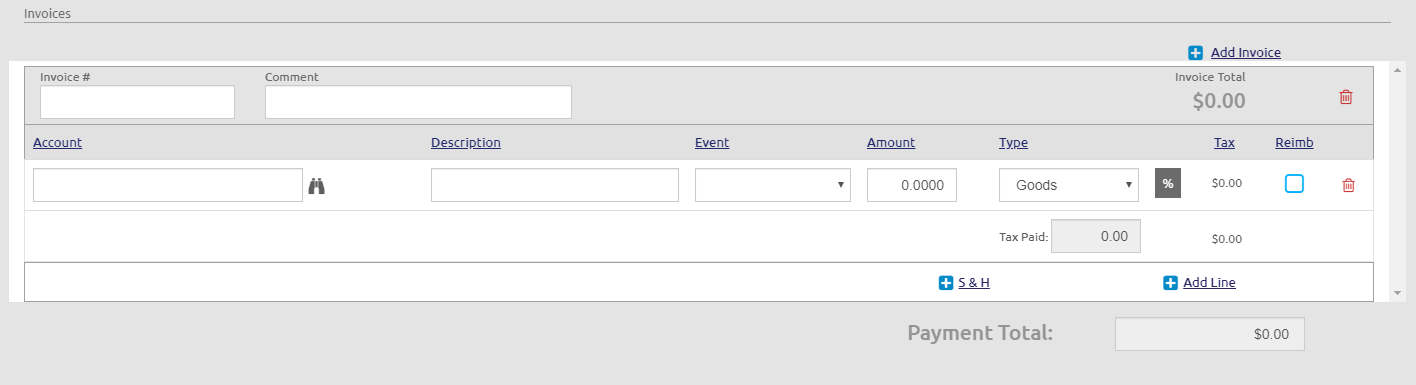

Invoices

- Click the

link once for every account you wish to add.

link once for every account you wish to add. - Enter the Invoice # and Comment.

- Enter the account number in the Account # field, or click the

icon to browse the available accounts. NOTE: If the account(s) being used on the PO are over budget, or will be over budget as a result of the PO, an Over Budget warning message will display on save.

icon to browse the available accounts. NOTE: If the account(s) being used on the PO are over budget, or will be over budget as a result of the PO, an Over Budget warning message will display on save. - Enter a short description of the account in the Description field.

- Select an event from the Event drop-down list.

- Enter the Amount.

- Select an option from the Type drop-down list.

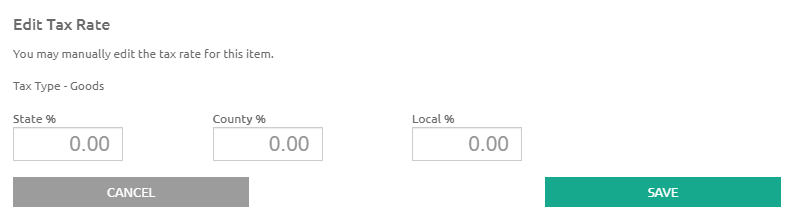

- Tax rate will default to the tax rate entered on the vendor. Click the

icon to edit the tax rate. The Edit Tax Rate form will display.

icon to edit the tax rate. The Edit Tax Rate form will display.- Enter the State %, County %, and Local %.

- Click the

button.

button.

- The Tax will be calculated automatically.

- Select the Reimb

box if this is a reimbursement invoice.

box if this is a reimbursement invoice. - Click the

icon to delete any line or account.

icon to delete any line or account. - Click the

link to add a line for Shipping and Handling.

link to add a line for Shipping and Handling. - Click the

link to add an additional to the invoice.

link to add an additional to the invoice. - Click the

link to add additional accounts to the PO.

link to add additional accounts to the PO. - Click the

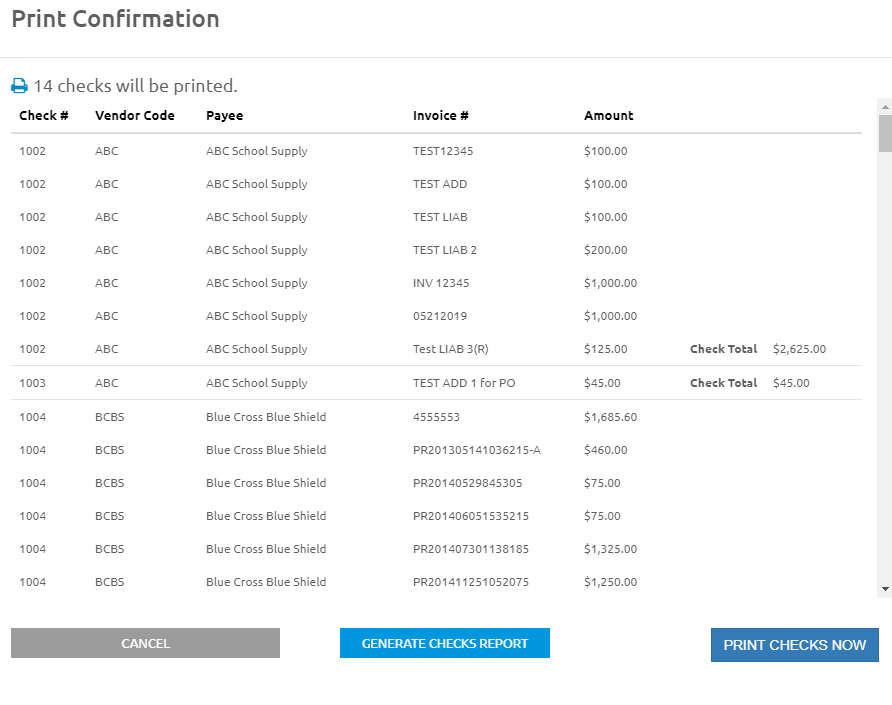

button. The invoices will be created and automatically selected for payment. A Print Confirmation page will display following the same steps as Print Checks or Processing EFTs.

button. The invoices will be created and automatically selected for payment. A Print Confirmation page will display following the same steps as Print Checks or Processing EFTs. - Click the

.png) button to be returned to the Process Payment screen. The invoices will still be created as open invoices in Manage Invoices.

button to be returned to the Process Payment screen. The invoices will still be created as open invoices in Manage Invoices. - Click the

button to generate the Print Checks Report.

button to generate the Print Checks Report. - Click the

button to print the checks.

button to print the checks.

- Click the

Process Payments

- Select the invoice(s) to be paid during this check run.

- Enter the Check Date or the EFT Date.

- For checks, the Starting Check # is defaulted to the next available check for this bank, but this is editable. For EFTs, the Starting EFT field is read-only and will use the next available EFT number for this bank.

- Print defaults to Vendor Name but can be changed to Vendor Code.

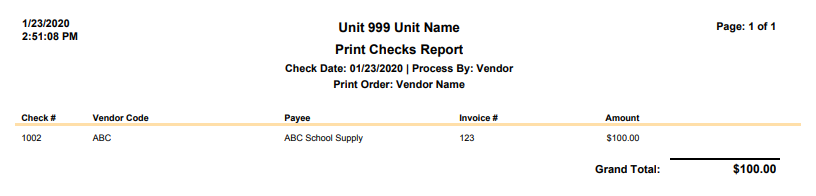

- Click the

.png) button. The Print Confirmation window will display.

button. The Print Confirmation window will display.

- Click the

to generate the Print Checks Report.

to generate the Print Checks Report. - If there are multiple invoices for the same vendor but different addresses, it prints separate checks for each address.

- If there are multiple invoices for the same vendor they are combined on one check unless you indicate Separate Check when the invoice is originally entered.

- Click the

button to print the checks once you have confirmed the list of checks to print is correct.

button to print the checks once you have confirmed the list of checks to print is correct. - If the list is not correct, click the

.png) button to be returned to the previous Process Payments screen.

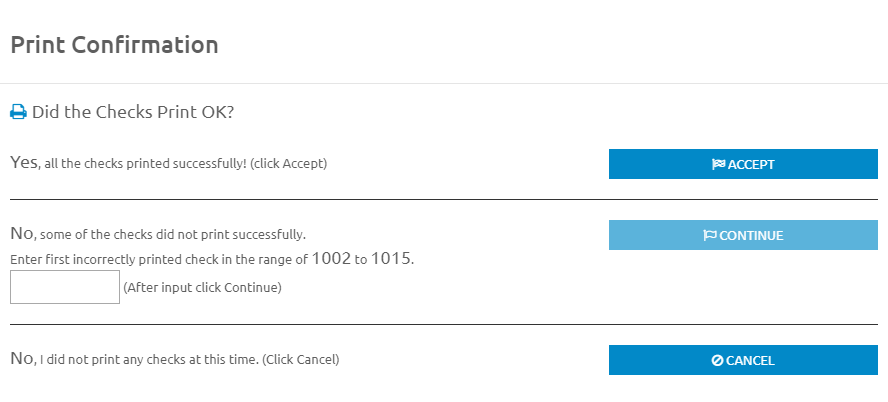

button to be returned to the previous Process Payments screen. - Once the

button is clicked, checks will be generated and sent to your printer. A Print Confirmation message will display. This screen allows you to complete the process or handle printer problems such as a paper jam.

button is clicked, checks will be generated and sent to your printer. A Print Confirmation message will display. This screen allows you to complete the process or handle printer problems such as a paper jam.- If the checks all printed successfully, click the button

.png) to complete the check process.

to complete the check process. - If some checks printed correctly but not all of them, enter the number of the first incorrect check and click the

button. The checks that printed correctly will be updated. The checks that failed will be logged for auditing purposes. The invoices will be marked unpaid so they can be reselected for payment.

button. The checks that printed correctly will be updated. The checks that failed will be logged for auditing purposes. The invoices will be marked unpaid so they can be reselected for payment.

- If no checks were printed, click the

.png) button. The failed check run will be logged for auditing purposes. The invoices will be marked unpaid so they can be reselected for payment.

button. The failed check run will be logged for auditing purposes. The invoices will be marked unpaid so they can be reselected for payment.

- If the checks all printed successfully, click the button

- If the list is not correct, click the

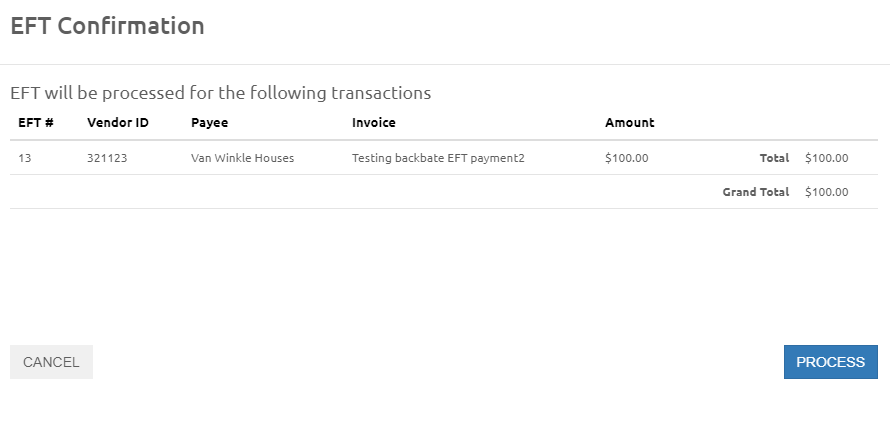

Processing EFTs

-

For EFT payments, an EFT Confirmation page will display a listing of EFTs to be processed.

- Click the

.png) button once you have confirmed the list of ETFs to process is correct.

button once you have confirmed the list of ETFs to process is correct. - If the list is not correct, click the

.png) button to be returned to the previous Process Payments screen.

button to be returned to the previous Process Payments screen. - An EFT Successful message will display when the EFT process is complete.

IMPORTANT! Only one user will be allowed to process checks at a time to avoid errors created by multiple sessions of processing checks at the same time. In the event that a check session does not close properly, the session can only be canceled by the user that the session is locked under. If that user is unavailable, please contact LINQ Support at 800.541.8999, option 2, and they will be able to assist.

NOTES: Zero dollar checks can be processed, but checks that result in a negative total amount will not be processed. If the check run contains a negative check, the user will receive a message indicating which vendor has the negative check.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021