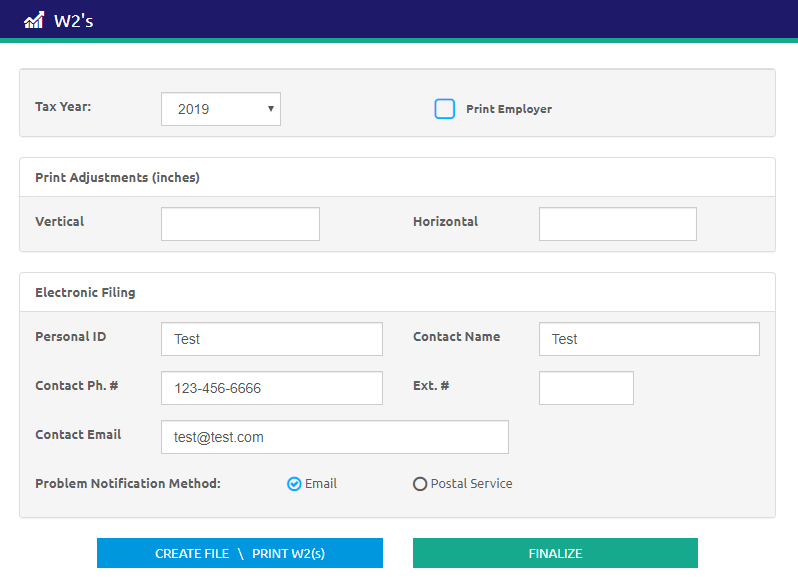

W2 Report

The W2 Report option is for printing employee W2 forms and creating an electronic file to be sent to the Federal and State Tax Authorities. To report all taxable income and taxes withheld during a calendar year for each employee, it is required by Federal law that employers provide each employee with a W2, and report all taxable income and taxes withheld to the government for income tax purposes.

- Select the tax year you are reporting from the Tax Year drop-down list.

- All employees with earnings recorded during the year selected will be displayed in the upper grid. It is based on checks that have been printed during the tax year and does not include “saved” pay periods.

- All employees listed in the grid will be selected to receive a W2.

- Check the Print Employer (Copy) box to print an employer copy of the W2s in addition to the employee copy. Employer copies print four employees to a form.

- Click the

button to create the files.

button to create the files.

Print Adjustments (Inches)

The fields in this section are optional and will be saved until they are changed again.

- Horizontal: Negative = left, Positive = right

- Vertical: Negative = up, Positive = down

Electronic Filing

The fields in the Electronic Filing section are used to electronically submit W2 information.

- Enter a personal ID # in the Personal ID field.

- The personal ID # is the PIN you received from the Social Security Administration.

- To register, request a new PIN, or for more information, visit: http://www.ssa.gov/bso/bsowelcome.htm.

- Enter the contact name in the Contact Name field.

- Enter the contact phone in the Contact Ph. # field, and the Ext. # if necessary.

- Enter the contact email in the Contact Email field.

- Select either Email or Postal Service for the Problem Notification Method. This will be used in case of any issues with the electronic filing.

Create File / Print W2(s)

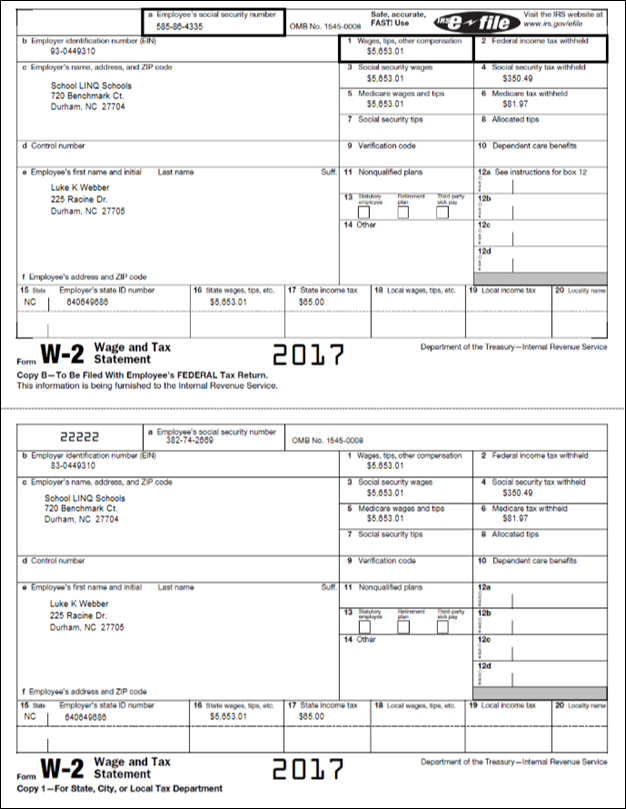

The W2 Report will print on the 4-up Form(employee Form 5205, employer Form 5405), which prints four employee copies per 8½x11 pre-printed form.

NOTE: if the information does not align on the print form correctly, use the Print Adjustments fields. The print can be adjusted up to 1/4" in any direction. To adjust up or left, use (-) in front of the number.

HINT: Print only one or two W2s on a form to test the alignment before printing several forms.

![]()

- Click the

icon. A prompt will display to save the W2 Report file that is created first. Save the file in a place you can easily retrieve it for submission online.

icon. A prompt will display to save the W2 Report file that is created first. Save the file in a place you can easily retrieve it for submission online.- The W2s will open into a PDF for printing.

- Once the employee copy of W2s displays, review the forms, or use the

icon to select a printer and print the form.

icon to select a printer and print the form.- If selected, the employer copy will display after the employee copy preview screen is closed.

- State Retirement will only print once in Box 14, even if the deduction is marked for Box 14.

- The last page of the employee and employer copies is a W2 total page, also referred to as a W3. This may be used to balance your W2s back to other reports such as a Trial Balance Report (Section 8.28).

- After the W2 file has been created, the W2 forms have generated, the file has successfully passed through AccuWage, and all W2 corrections have been made, the W2s can be finalized.

- When the W2s run, it will automatically save the last run but not mark them as “final” until the

.png) button is clicked. After the W2s are finalized, no changes can be made.

button is clicked. After the W2s are finalized, no changes can be made. - If the W2 report screen is closed and re-opened, a message will display asking what the user wants to do.

- If Yes is clicked, W2s will be recalculated, and any changes you made will be picked up.

- If No is clicked, the same W2s information from the previous run will be used.

Sample W2 Report

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021