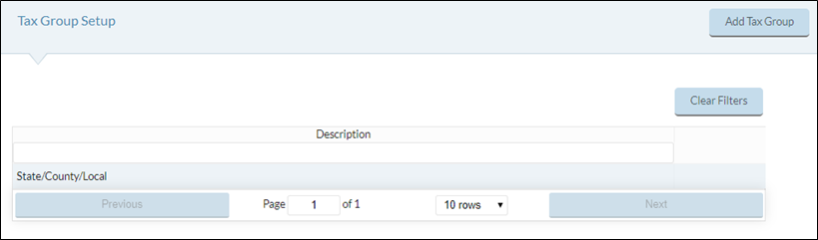

Tax Group Setup

Tax Groups allow you to define sales tax rates to apply to inventory Items. You can set up multiple tax groups if different tax rates apply to different Items. Example: food processing supplies may be taxed differently from cleaning supplies or equipment.

You can skip this section if you never need to calculate and apply sales tax on Purchase Orders or Invoice Accrual.

- Click the

button to add a new Tax Group.

button to add a new Tax Group.

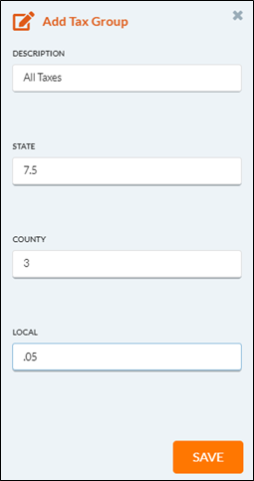

- Enter a Description for the Tax Group.

- Enter the applicable tax percentages in the State, County, and Local Fields.

- Click Save when complete.

-

Hover over a Tax Group and click the

Cog Option that appears to Edit or Delete Tax Groups.

Cog Option that appears to Edit or Delete Tax Groups.- Click Edit to update an existing Tax Group Description.

- Backspace to erase the Description field and enter a new Description.

- Click Delete to delete a Tax Group.

- Click Edit to update an existing Tax Group Description.

©2021 EMS LINQ Inc.

Meals Plus Web Help, 10/2019